From August 2025, the United States introduced new import tariffs on goods shipped from the UK. This has impacted products sold and shipped through Papello, particularly those fulfilled to US customers.

We’ve been monitoring charges carefully since launch, and this article will guide you through:

- Why tariffs were introduced

- How Papello calculates duties at checkout

- Changes we’ve made since launch

- What sellers need to do

Why Tariffs Were Introduced

The US government introduced reciprocal tariffs on UK-origin goods. These apply in addition to the existing General Duty Rates already set out in the Harmonized Tariff Schedule (HTS).

In short:

- Products can now have two layers of duties (General Rate + Reciprocal Tariff).

- Even products at 0% tariff may incur handling fees charged by Royal Mail for processing customs declarations.

How Duties Are Calculated

Papello uses a Landed Cost Calculator to determine the estimated duties for each product based on its HS code.

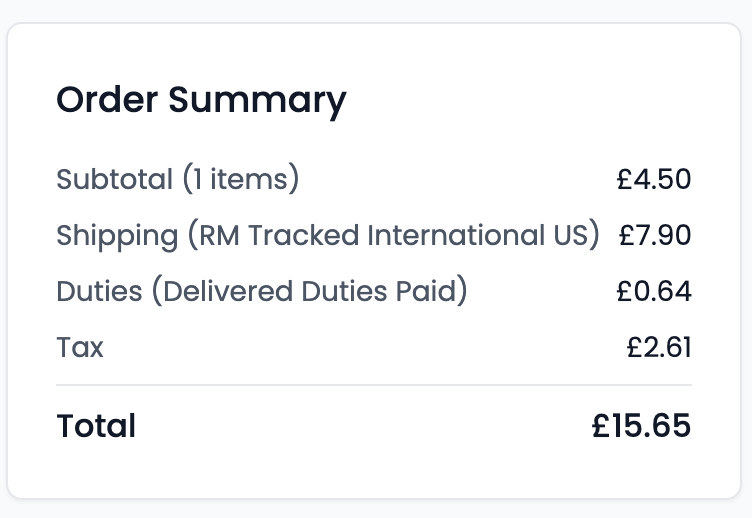

At checkout in the Papello Dashboard, you’ll see duties included in the order cost. This ensures:

- PDDP (Pre-Declared Duties Paid) on every shipment

- No surprise charges for your customers at delivery

- Accurate reporting of costs up front

Examples of Duties

Here are some current examples based on products we sell:

For an order with 2x PP-EAM-A5 products (£4.00 each):

Step 1: Calculate Dutiable Base

- Product value: £8.00 (2 × £4.00)

- Total dutiable base: £8.00

Step 2: Apply Tariff Rate

- Tariff rate: 2%

- Base duties: £8.00 × 2% = £0.32

Step 3: Add API Landed Calculator Call Cost

- API call percentage: 2.5% of the duties amount

- API call amount: £0.32 × 2.5% = £0.008

- Duties with API Call: £0.32 + £0.008 = £0.328

Step 4: Add Royal Mail Handling Fee

- Royal Mail handling fee: £0.50

- Total duties: £0.328 + £0.50 = £0.83

Key Points

- De Minimis Threshold: If the de minimis threshold is set to 0, duties apply to all orders regardless of value

- Duty Buffer: A 2.5% buffer is added to account for currency fluctuations and carrier fees

- Royal Mail Handling Fee: A fixed £0.50 handling fee is applied to all international shipments

- Per-SKU Calculation: Duties are calculated separately for each unique product SKU in your order

The final duties amount (£0.83 in this example) is then added to your order total and is subject to tax calculation.

👉 Note: Tariffs and handling fees vary by product and are updated automatically in the Dashboard.

Changes Since Launch

We’ve issued several updates as the situation has evolved:

- Initial Launch – Tariffs added into the Dashboard with estimates based on HS codes.

- Royal Mail Pause – Shipping to the US was temporarily paused before recommencing under PDDP.

- Landed Cost Accuracy – We began cross-checking actual duties collected vs estimates.

- Adjustments – Some products had duties reduced, others increased, to align with real-world charges.

- Handling Fees – Royal Mail confirmed that even 0% tariff products incur a small handling fee (1–3%).

What You Should Do as a Seller

- Check duties at checkout – The Papello Dashboard always shows the most up-to-date costs, including handling fees.

- Adjust pricing if needed – You may choose to absorb these costs or pass them onto customers by adjusting your US pricing.

- Use Zonos’ free calculator – Preview expected tariffs here: Zonos Landed Cost Tool.

- Stay Updated – We’ll continue to update duties in the Dashboard as real charges evolve.

Final Notes

These changes only apply to US orders. Other regions are unaffected.

We’ll keep monitoring duties closely and ensure sellers always see the correct charges before orders are submitted.